- The 11 Best Landing Page Builder Software Tools [2024] - April 16, 2024

- 17+ Best AI Writing Software Tools [2024] - February 15, 2024

- How to Grow Your Ecommerce Business Exponentially: 11 Growth Hacks - January 6, 2024

Like most entrepreneurs and marketers, when I began my career, I was fixated on acquiring the most customers. Even if my customers were spending only $10, I was thrilled to have them!

Don’t get me wrong. I still love acquiring tons of users.

But if all you care about is how many customers you’re acquiring, you’re missing the most important metric in all of business: customer lifetime value.

Table of Contents

Enter: Customer Lifetime Value (LTV)

Do you know the average Starbucks customer spends $14,099 over their lifetime?

That’s a whole lot of caramel macchiatos and scones.

While math isn’t everyone’s strong suit, every marketer and entrepreneur needs to understand lifetime value. Because not all customers are created equal.

I’d rather have 50 customers worth $1,000 each than 1,000 customers worth $50 each.

Why?

- Almost every business pays to acquire customers. Whether you’re running Facebook Ads, Google Ads, PR or using SEO to acquire users, almost every business has to pay to get customers in the door. If each customer is only yielding you a few bucks, your acquisitions will be very unprofitable and your business will flush a ton of money.

- Customers take work to manage. It’s much easier to field customer support inquiries or manage accounts for 50 customers than it is for 1,000 customers.

- It’s easier to scale a business with high value customers. High value customers give you the dollars to spend more on product development and marketing.

- Premium pricing = premium offering. There’s a whole psychology around pricing, but in many ways, a premium price equates to a premium product offering in the customer’s mind.

How to Calculate Customer LTV

Customer LTV is an easy metric to calculate.

In simplest terms, it’s how much revenue or profit your average customer makes your business during the life of their relationship with your business.

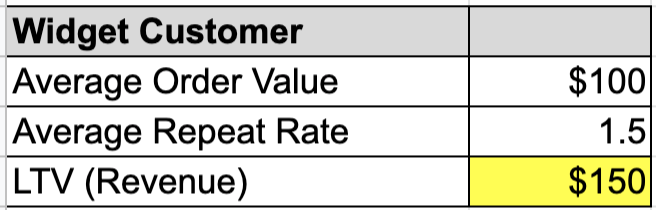

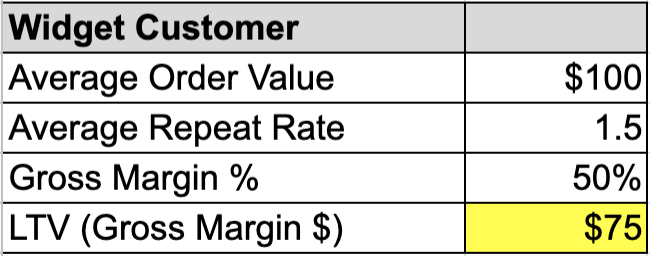

So if most of your customers spend $100 in their first visit and 50% of them come back for a 2nd time and spend $100 again, your customer LTV is $150.

Some people (myself included) speak about customer LTV in terms of profit — removing cost of goods sold. In the example above, let’s say your profit margins are 50%, because every $100 purchase costs you $50 to fulfill (because of cost of goods, shipping, customer support, etc.).

Sadly, in this view of lifetime value, your customer LTV is only $75.

This means, to acquire customers profitably, you need to spend less than $75 to get them in the door.

How Technology Companies think About LTV

Not that technology companies are the benchmark of great business decision making… In fact, many technology companies are the most cash-wasting, belligerent, drunken sailor, spending machines of all time.

But venture capitalists, who spend lots of time sitting in their Teslas studying great businesses, have honed in on customer LTV over the last few years.

Alex Taussig of Lightspeed Venture Partners says: Repeat customers are the lifeblood of your business. Measuring the velocity of their return, and the value they contribute upon each return, is the most objective way to measure your performance (source).

Interestingly, the venture capital community isn’t only interested in your customer LTV at a point in time, they’re interested in continuing to calculate this metric over and over again to establish map points as your business grows.

If your customer lifetime value increases over time, you know you’re making a better impression on your customers. You can then reverse-engineer the experience for future customers.

The best businesses both acquire more customers and acquire ones that are more profitable than the last set of customers.

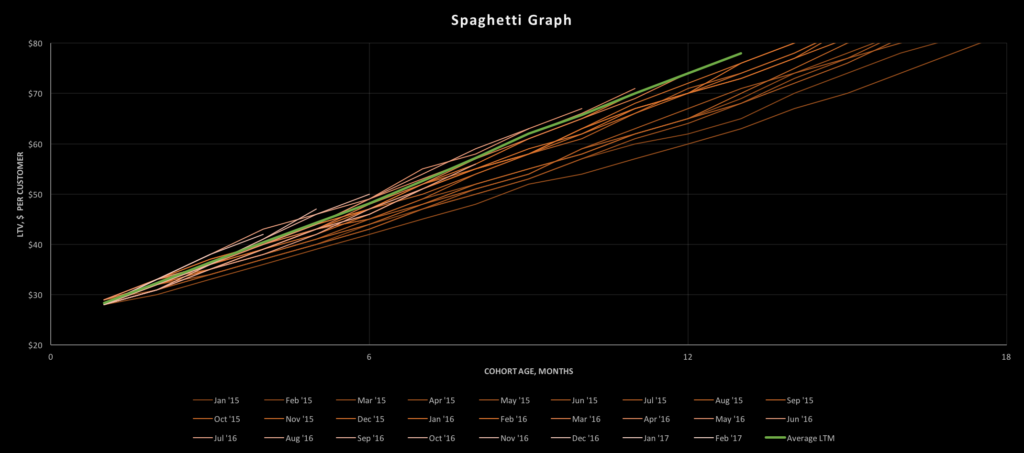

Venture capital firms like Lightspeed love to use a “spaghetti graph” to show customer lifetime value over time.

While it’s a bit difficult to understand at first, what the above graph does is break customers out by cohort — the month they were acquired — to detail the lifetime value for each one of those cohorts over time.

A business that is acquiring increasingly more profitable customers will have steeper lines for newer cohorts — implying that new customers are yielding more money for the company, faster.

The best companies are constantly measuring their lifetime value over time. Many companies even break out LTV by acquisition channel — yup, users acquired from Facebook may be of different value than ones acquired via SEO or Google Ads.

Of course, depending on your company size, getting really surgical with this stuff may not be necessary.

5 Ways You Can Improve Customer LTV

This is all great in theory. But what can you actually do to move the needle for your business?

1. Focus on your highest value customers

Said very simply, the Pareto Principle (also known as the 80-20 rule) states that roughly 80% of the effects come from 20% of the causes.

When applied to your customers, the rule of thumb is that 80% of your sales come from 20% of your customers.

So if you’re going to spend time doing anything, delight your highest value customers. Here are some ideas of how exactly to do that…

- Send your best customers gifts, discounts, cards, friendly notes or even pick up the phone and tell them how much you appreciate them. These users are the lifeblood of your business. Treat them like gold!

- Either by emailing them or by using a referral software, ask your best customers to refer their friends and family. The friends and family of your best customers will likely also be great customers.

2. Improve your product offering

Speaking to your best customers will help you tweak your offering to better suit them, which will increase the amount of money that your customers spend with you.

- If you’re selling a software tool, perhaps your customers will tell you they want another feature.

- If you have an ecommerce store, survey your customers and let them tell you which products to produce next.

- If you are a service business, make sure to gather feedback from customers so that you can serve future customers better.

Great product offerings keep customers coming back for more. It’s as simple as that.

3. Start selling something else your customer wants!

Why do you think Apple just launched a credit card?

Why do you think Uber and Google just got into the lending business?

Why does Amazon offer grocery delivery, movie rentals, furniture and a million other things?

All of these companies have brand names and tons of existing customers. They know they can effectively cross-sell customers. Existing customers cost nothing to acquire. Selling additional products to them is pure profit!

4. Reactivate churned users

There’s a reason most email marketing software tools have reactivation campaign features.

If your customers haven’t transacted in a while, don’t let them disappear into the ether. They still know your brand and you’ll have a much easier time converting them than you will some prospect on Facebook or Google whose never heard of you.

Do whatever it takes to bring them back into your business ecosystem — treat them to discounts, special offerings, or even just shoot them a “we miss you” email.

5. Slice the data

Again, there are certain segments of customers who are more profitable than others. Understand which ones those are so that you can spend your marketing efforts on acquiring and nurturing those customers.

- Healthcare companies know that women are more profitable — they often coordinate doctor visits and other healthcare spending for the family.

- Ecommerce apparel companies take note, women spend 76% more than men on clothing.

- I’ve historically seen Google Ads customers perform better than Facebook customers — and customers that come through press are even better… generally speaking, from my experience.

Slice your data a few different ways. You may find valuable segments of high lifetime value users.

Conclusion

Understanding lifetime value is going to keep you ahead of your competition. It’s the most obvious, but often overlooked way of winning in business.

Subscription revenue companies like Amazon and big b2b companies like Salesforce are highly valuable for a reason — each customer generates them a ton of profit.

If you can outspend your competition on product improvements and marketing, you’re going to win. Take LTV to heart when developing your product, pricing it and winning back repeat business. You’ll be happy you did.